Highlights

RegTech

Regulatory monitoring, reporting, and compliance with the help of information & technology

ML / CFT

Discussing the new challenges and ways and their solutions, like TBML, environmental money Laundering

KYC

Understanding the role of data in KYC to identify suspicious activity and enhance the customer experience

Scam Techniques

Managing the increase of fraudulent attempts and sophisticated scam techniques

Covid 19

Reviewing the changing fraud landscape in the context of Covid 19

Cross-Border Cooperation

Increasing cross-border cooperation to reduce criminal operations

Internal Fraud

Addressing internal fraud risk in a newly digital work environment

Ransomware

Treatment of ransomware cases with increasing risk of occurrence

Conduct and Culture

Developing financial crime conduct and culture to increase effectiveness over compliance

Sanctions

Navigating the shifting sanctions landscape and understanding the implications on organizations

Event Speakers

Our 2022 Thought Leaders

Joana Neto

AML/CFT Data Specialist

Matt Cumbers

Head of Compliance

Claire Maillet

Head of Financial Crime

.jpg)

Giles Thomson

Director, Office for Financial Sanctions Implementation (OFSI) and Economic Crime

Prof. Dr. Ilin Savov, ScD

Department of Operational and Investigative Activity Faculty of Police

Salim Thobani

Senior Vice President & Head of Foreign Exchange Monitoring Unit

Claude Bocqueraz - Möhrle

Policy Officer-DG FISMA

Elina Karpacheva

Governance & Compliance specialist, Lawyer, Researcher

Delivering an exceptional virtual event experience including:

Watch presentations, fireside chats and panel discussions from top industry thought-leaders all day, every day!

Comment and question in real time. Spark conversations with your fellow attendees and build those relationships with instant chat, video calls and discussion groups.

Get in-depth answers in real-time with our live Q&A sessions with every presentation and panel speaker!

Missed a session? Catch-up in your own time through our on-demand service for 2 weeks.

Create your own conference agenda and export it to your calendar, so you don’t miss business critical sessions.

Meet and build relationships with fellow attendees who share the same challenges and interests.

Acknowledgement & Appreciation

DISCUSSION TOPICS

Who Will Attend

100+Attendees, ranging from Heads, Directors and Chiefs of Fraud, Financial Crime, Cyber, Security, AI, Automation, Analysts, Anti Money Laundering Officers, Anti-bribery, Anti-corruption, Risk, Compliance Officers, Data, Technology, Intelligence from across the Financial Services

Financial Fraud is Costly to Enterprises and on the rise

Source: PWG Global Economic Crime and Fraud Survey 2018

Event Schedule

Have a look at Schedule

Registration

Opening Remarks by World BI

Chair Welcome Address

Claire Maillet, Head of Financial Crime, Jaja Finance

Presentation 1

The issue at hand: Possible consequences of an organization’s failure to manage the risk of financial crime

Claire Maillet, Head of Financial Crime, Jaja Finance

Presentation 2

AML package adopted by the Commission

Claude BOCQUERAZ, Policy Officer-DG FISMA, European Commission

Presentation 3

Effectiveness of Regtech solutions in fighting economic crime

Elina Karpacheva, Governance & Compliance specialist, Lawyer, Researcher, European Compliance Center

Presentation 4

Financial crime risk cover in trade finance

SALIM THOBANI, Senior Vice President & Head of Foreign Exchange Monitoring Unit, Meezan Bank

Presentation 5

The link between technology and AML/CFT: Developing and/or enhancing your AML/CFT framework based on regulatory requirements and leading industry practices

Joana Neto, AML/CFT Data Specialist, European Banking Authority

Presentation 6

The Financial Crime Lifecycle: Maintaining focus throughout the customer journey

Matt Cumbers, Head of Compliance, Habito

Presentation 7

TBC

Prof. Dr. IlinSavov, ScD, Department of Operational and Investigative Activity Faculty of Police, Academy of the Ministry of Interior

Final Remarks

End of the conference

Book Your Seat

Get yours why they are still available

Global Marketing

- 1 Attendee Pass

- Inclusion of company logo and profile in welcome pack

- Global marketing and branding for lead generation purpose

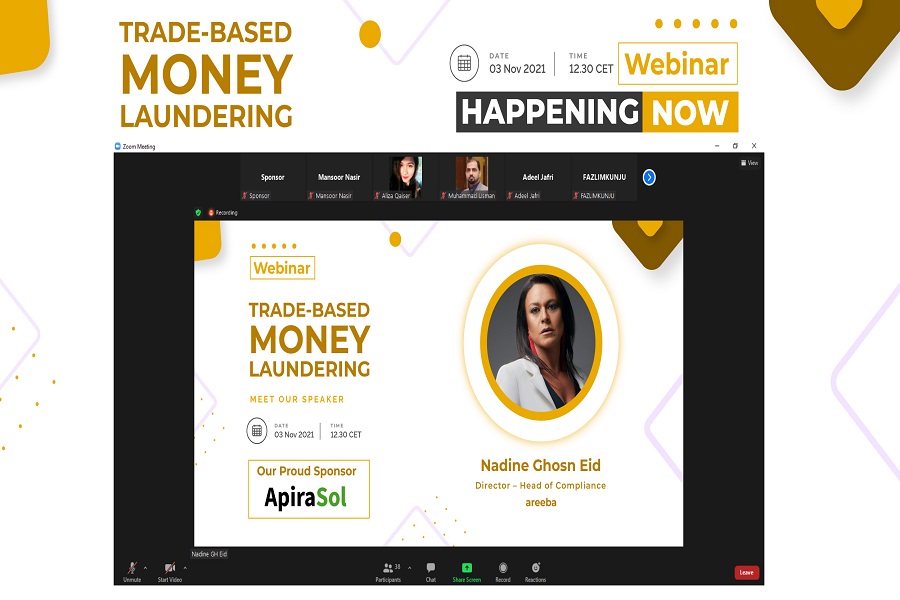

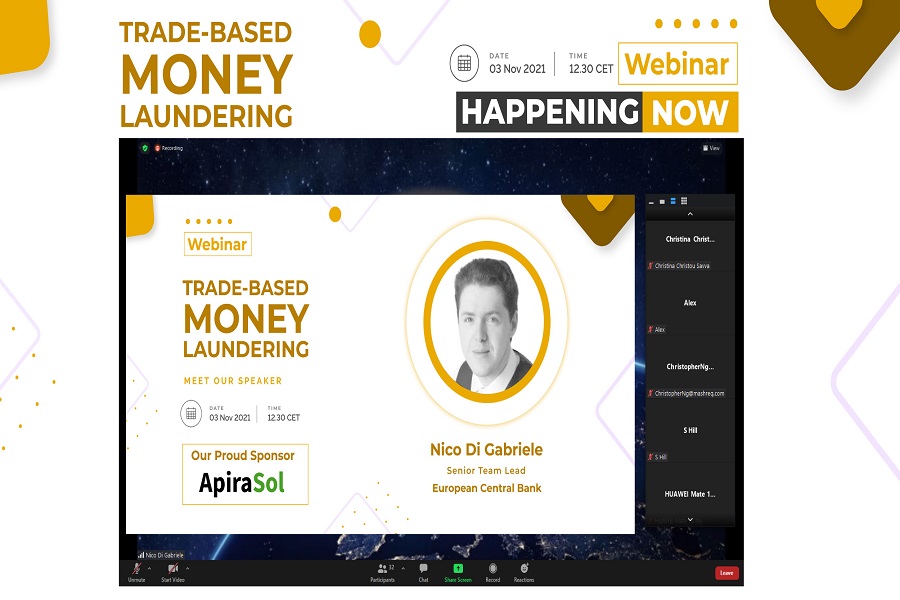

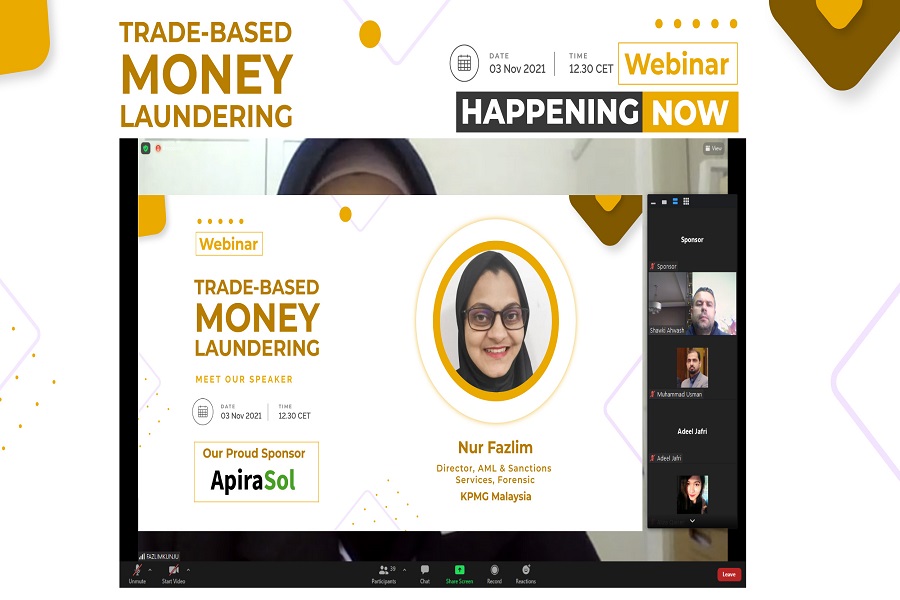

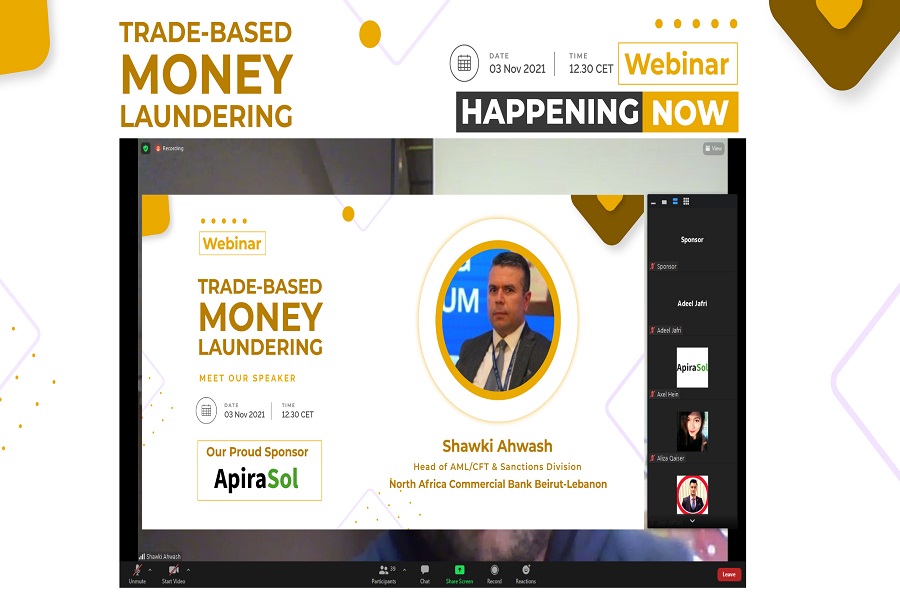

Gallery

Check our gallery from the recent event